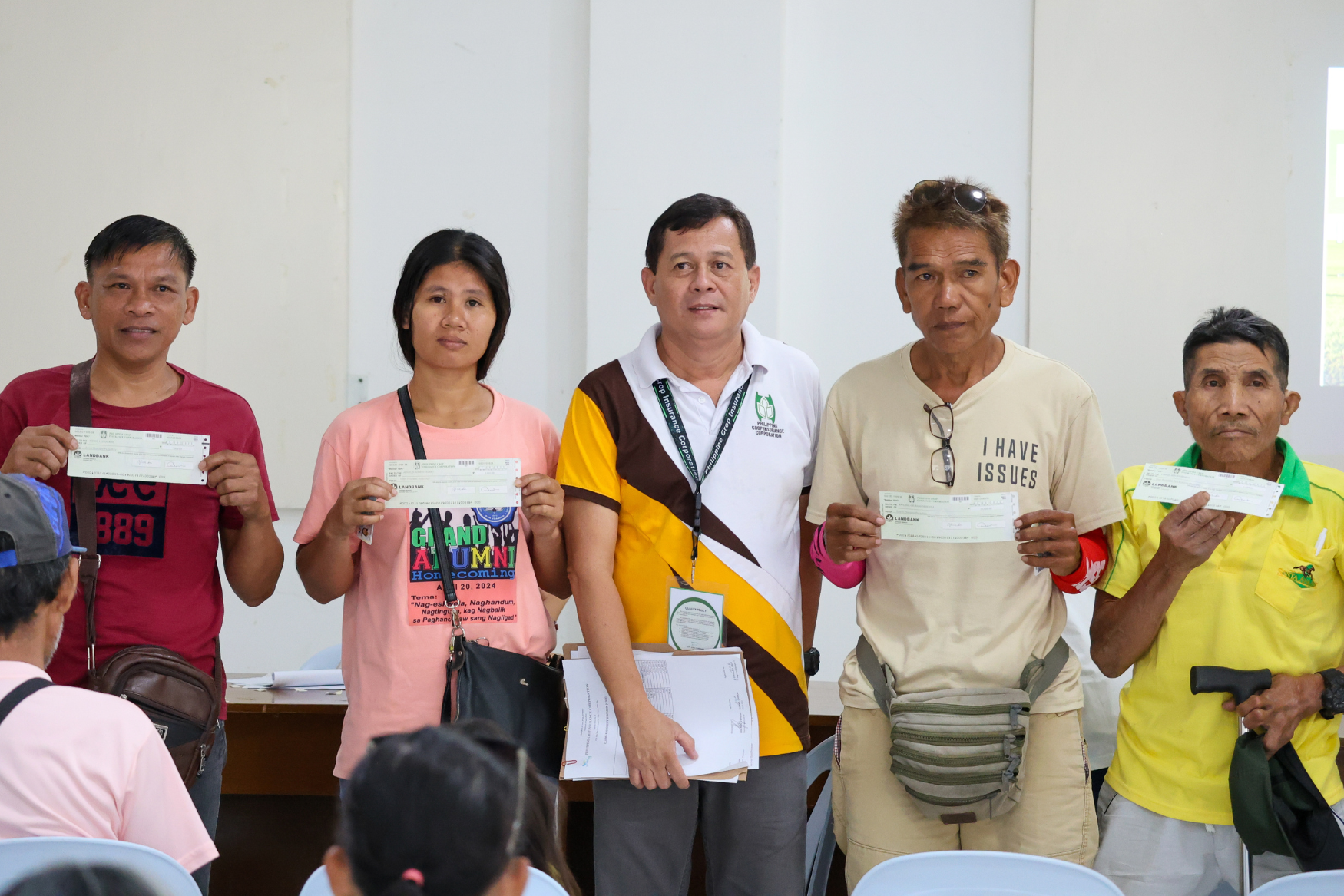

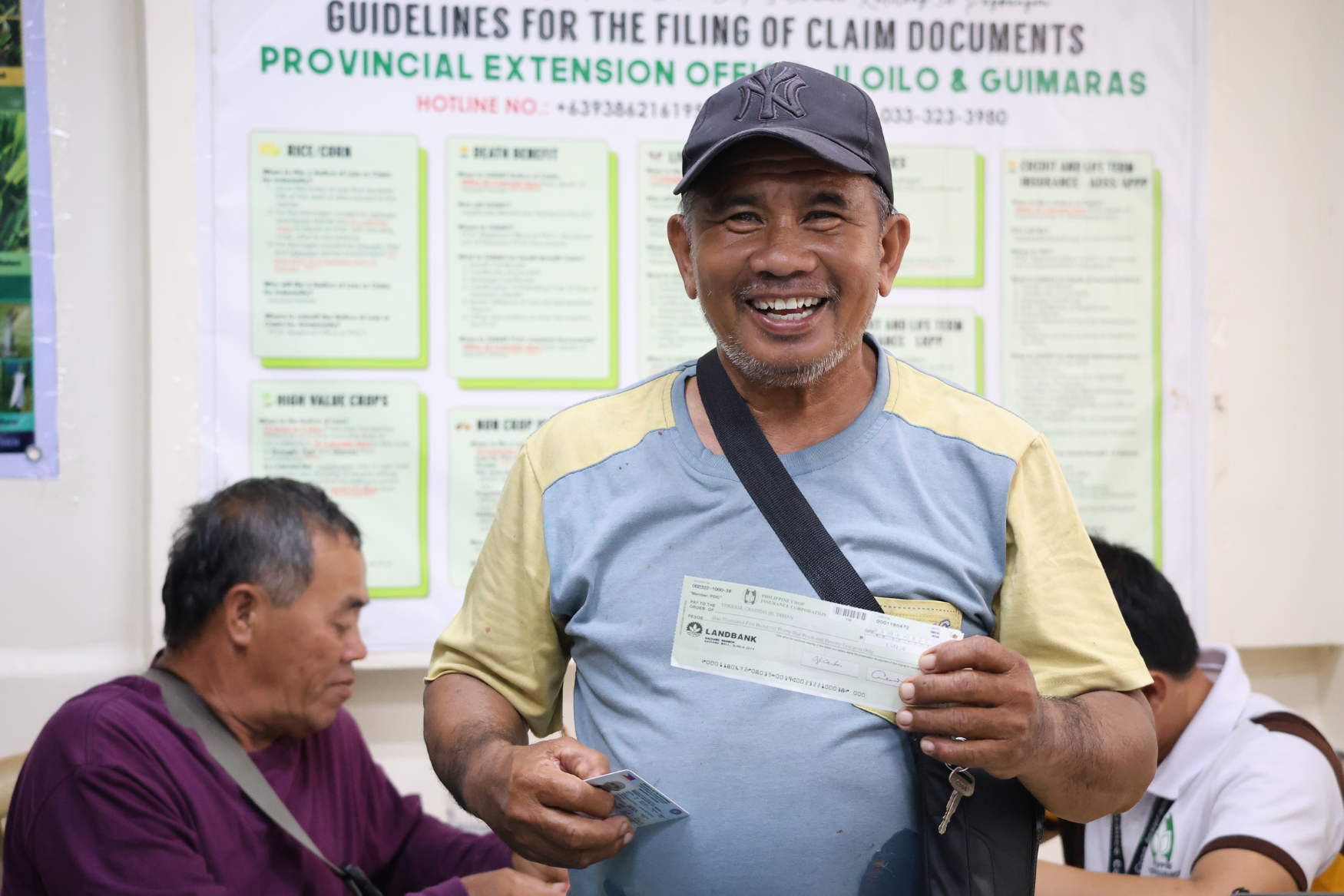

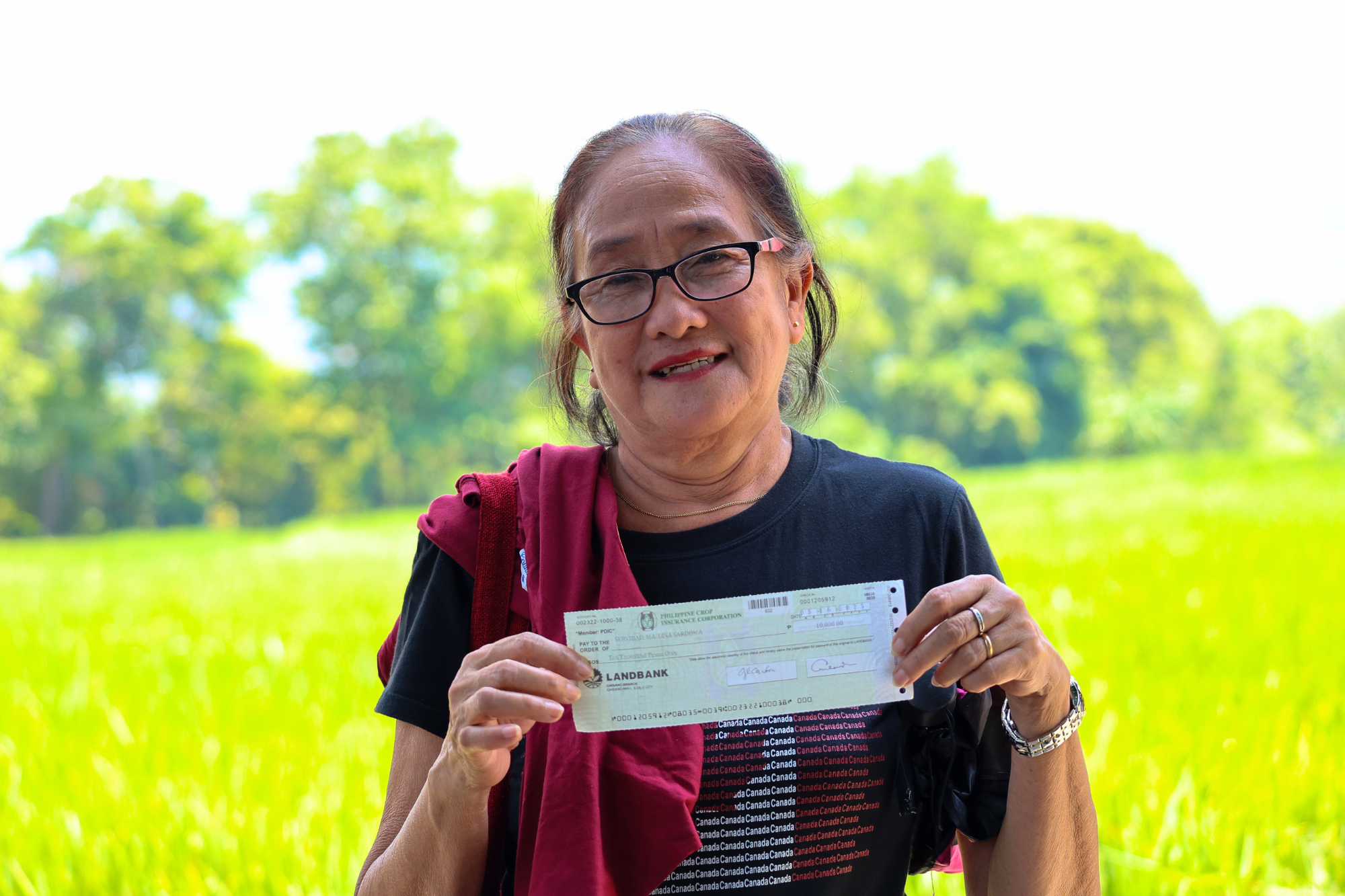

PCIC distributes over P241M indemnity to Iloilo farmers, fishers

Posted by: RAFIS DA6 | Posted at: August 6, 2025

The Department of Agriculture (DA) Philippine Crop Insurance Corporation (PCIC) Region 6 has started rolling out Php 241,450,260.16 worth of indemnity claims to assist 49,306 farmers and fisherfolk in Iloilo Province who suffered agricultural losses from January to July this year.

The indemnity support aims to help local food producers recover from damages caused by prolonged drought, flooding, and pest infestations.

According to Glenn Carbon, Claims and Adjustment Division Chief of PCIC Region 6, the recent onslaught of Tropical Storm Crising had further aggravated the damage, which heavily affected farmers in the northern part of the province, particularly in the municipalities of Balasan, Lemery, and Sara.

“Because of the significant damages brought about by Typhoon Crising, we have fast-tracked the indemnity payouts in every municipality in the province, starting August 1. This is important for farmers to bounce back quickly after the losses,” Carbon said.

He noted that rice remains the most affected commodity in the province, with 44,912 rice farmers incurring losses across more than 34,000 hectares. Corn farmers followed closely, with 3,411 growers affected by erratic weather patterns earlier this year.

PCIC’s indemnity program covers not only rice and corn but also high value crops, vegetables, livestock, fisheries, and non-crop assets, such as agricultural machinery and infrastructure. It also includes credit and life term insurance for enrolled beneficiaries.

The agency continues to encourage farmers and fisherfolk to register under the DA’s Registry System for Basic Sectors in Agriculture (RSBSA) to avail themselves of free insurance coverage from PCIC.

Carbon shared that a total of 50 adjusters have been deployed in the municipalities in Iloilo to accelerate field validation and insurance claim processing. In order to enhance the efficiency of future insurance payouts and improve responses to crises, PCIC has employed advancements in technology. It has entered into partnership with GCash and Palawan Payment Center to allow beneficiaries to directly receive their indemnities in a safer and more convenient approach.

PCIC President Atty. Jovy Bernabe, in his pronouncement in July, affirmed the agency’s shift toward digital transformation. “We are implementing a parametric insurance system at PCIC, in line with the President’s directive to digitalize our services and utilize the latest technology to benefit our farmer clients.”

Bernabe explained that the system will leverage satellite imagery, remote sensing, and data from the Philippine Rice Research Institute to assess damage. With geo-tagging and geo-referencing in place, PCIC will be able to process and disburse payments within three to five days after a storm or typhoon has occurred.

Local government officials have commended the corporation’s proactive response and committed support in encouraging more farmers to enroll in crop insurance and RSBSA.

Farmers and fisherfolk are encouraged to immediately report any agricultural damage to their municipal or city agriculture offices within the prescribed timeframes to allow faster process for indemnification. Damage to palay and corn must be reported within 20 days, high-value crops within three days, livestock and poultry within seven days, fisheries within two days, and machinery and infrastructure within three to 10 days.### Text by Sheila Mae T. Cocjin & Photos by Khrysma Dei C. Caldina/DA-RAFIS 6